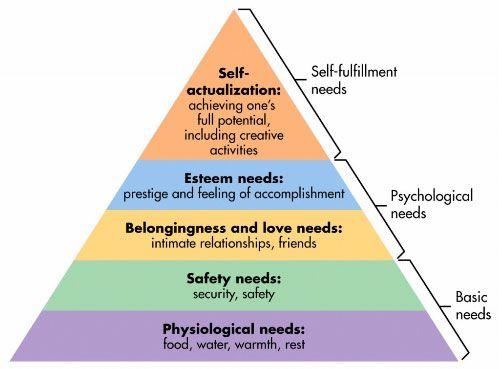

It’s a theory of human motivation. We aim to fulfill the needs at the bottom before working our way up. Need for prestige is not present when we don’t have food or water. Our personal safety is less of a concern if we don’t have food and water. Once you have the first level, you start wondering about the second. (the levels aren’t this cut and dry but the idea is still useful)

Maslow’s Hierarchy of Needs is a framework that can help you understand how you spend your money and your life.

How do I use the hierarchy of needs

The hierarchy can help explain the motivation behind why people behave a certain way.

Here’s how you can use the hierarchy to guide you and help you make better decisions —

Everyone is striving for the fulfillment of every level of their hierarchy of needs. The lower ones have higher priorities, but at our core we’re seeking to fulfill them all.

Before you commit that next dollar, think about the need it is fulfilling. Are you looking to satisfy higher needs at the cost of lower ones? Are there alternatives that might cost less or fulfill that specific need better? Is it even fulfilling the need you think it is?

Let’s take a very simple example – a purse is just a bag. Functionally, it holds stuff.

In reality – it does so much more.

You can buy a $20 one from Target or a $150 one from Coach or a $15,000 one from Louis Vuitton.

Why do some people buy the $15,000 version? Because it makes them feel good. It gives them prestige and it is the fruit of their labor.

There are people who can buy $15,000 handbags but buy the $20 one instead. It’s not because they’re cheap but because they don’t associate prestige with a handbag. They don’t get $15,000 of value out of the bag. It doesn’t make them feel $15,000 good.

The folks who spend that much have a reason too. Maybe they buy those handbags so they appear more appealing as they seek out friends and intimate relationships. Maybe they do it because they feel they deserve it – so it’s a reward for past behavior. Whatever the case, it’s not “stupid.” It merely is what it is.

This applies to everything – cars, houses, clothes, jewelry, … this list never ends.

The Prime Directive of Personal Finance is that you should “Avoid committing future funds to spending obligations; commit them to saving obligations.” Before you commit your funds, consider the purpose and whether you’d be better off making a trade.

If a handbag is unrelatable, how about shelter?

A house is a prime example of how understanding the hierarchy is so important and how it intersects with the Prime Directive of Personal Finance.

A house hits every layer of the hierarchy of needs:

- Physiological needs: The most obvious, a home provides physical warmth and rest.

- Safety needs: Your home is your sanctuary, a place where you can lock the doors – you feel safe and secure.

- Belongingness and love needs: When you put down roots, it’s far easier to build lasting relationships.

- Esteem needs: Homeowners are seen as having more prestige than renters. Owning your home is a badge of honor. A nicer home is better than a less nice home.

- Self-actualization needs: A home may not check off this need but it enables you to pursue it, perhaps giving you a place within the home that you can be creative –

a workshop, a studio, something of that nature.

Houses, like many things, have luxury versions. You can buy a small house or you can buy a massive McMansion. Or you can buy a cottage in the woods. They satisfy each of the levels to varying degrees but can have widely divergent costs.

Warren Buffett has lived in the same house since 1958. It’s a nice home in Omaha, NE that he purchased for $31,500. It has five bedrooms and 2.5 baths. He’s worth ~73.5 billion dollars. He could easily buy many many MANY lavish homes anywhere he wants and not even notice it. But he doesn’t and there’s a good reason.

He’s fine with the equivalent of a Coach handbag, he doesn’t need the Louis Vuitton bag because he doesn’t need (or care about) the prestige associated with it. He already has it elsewhere in his life.

As you go to buy your house, are you buying that much house because you need that much space or are you trying to satisfy another need? Are you committing to 15/30 years of payments to get something you could get in a $1,000 handbag? 🙂

How debt flips the hierarchy upside-down

Where things get ugly is when you introduce credit and debt.

If you want to buy a $15,000 handbag and don’t need to go into credit card debt to buy it, by all means. There is nothing wrong with buying it with cash to satisfy your prestige need. Anyone who says otherwise is simply signaling they don’t care about handbags, nothing more.

If you put it on a credit card, that’s when it’s a problem. A big problem.

Debt allows you to borrow money from your future self at a discount. By discount I don’t mean you get it cheap, I mean you get less than 100% of your future income but you get it today, rather than when you would’ve earned it. When you put something on your credit card, for all practical purposes, your interest rate is the discount rate.

With debt, people can now “spend beyond their means.” This is great when you want to make investments in yourself and your system. A mortgage gives you access to a more predictable living situation. A car loan gives you access to a car. A student loan gives you access to higher education and skill building.

But debt introduces more problems. Debt can be used on “needs” as easily as they can be used on investments.

People often live beyond their needs because they are looking to satisfy one of their higher needs. The engine of their financial life, their ability to earn, hasn’t increased but they’ve already borrowed against their future self. The motivation is obvious – just look at Maslow’s Hierarchy.

Debt is dangerous when you use it on satisfying a higher need because debt is very expensive. If your earning ability doesn’t also increase, introducing debt means you’re on the same treadmill of life… it’s just going faster now. When you use it on an investment in your earning potential, like education, you accelerate future income but you also increase your earning potential today.

When you spend money, the question you have to ask yourself is – what need am I satisfying?

It’s your money, spend it however you want

Before you think this is a “spend only on function!” post – it’s not.

Take me for example – I really enjoy vacations. I enjoy visiting new places, having new experiences, and living a life that isn’t mine if only for a short time. (the new places thing is why a timeshare isn’t for me)

Functionally, vacations are hard to defend financially because they create nothing tangible. They create memories (memories appreciate!) but it’s not like a bag. They don’t do anything… but I love them nonetheless.

It is your money and you can spend it however you want. Some people spend more on food. Some people spend more on security. Some people spend more on relationships, prestige, whatever!

You made that money and you don’t need anyone else’s permission.

You need the permission of your future self.

You must be honest with yourself as to the true motivation. Companies spend billions a year on advertising to appeal to these needs, educate yourself so you can adequately defend yourself. If you are honest with yourself, spend without guilt. You earned it.

SOURCE: https://wallethacks.com