Real Estate

Real Estate has been proven to be one of the most profitable investment opportunities currently available in Nigeria with relatively low variability of returns. It involves the purchase, ownership, management, rental and/or sale of real estate for profit. How-ever, investors must be aware of the relatively long tenure of holding period that may be required. The location of such an investment usually has an important impact on the holding period required for a rewarding transaction. There are three major types of real estate namely:

The Commercial Real Estate

These properties are used solely for business purposes and an investor (developer) usually owns the building and collects rent from each business that operates within the structure. Sometimes, the developer could build for outright sale and subsequently appoint a facility manager. Some of the major categories of commercial real estate include:

· Ultra-modern malls and event centers

· Office buildings

· Recreational Centers

· Concessions including Roads, bridges, Free Trade Zones and ports

· Hospitality

· Restaurants & Fast Food Outlets

We estimate that 60% of global investment in real estate is in commercial real estate.

The Residential Real Estate

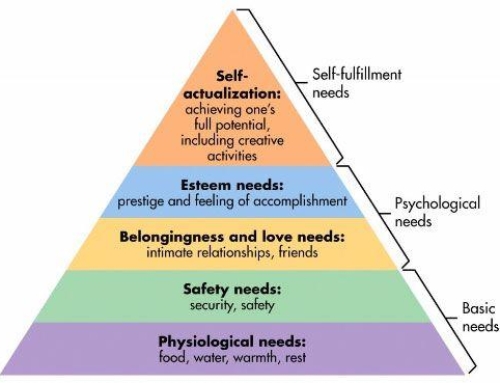

This type of properties are meant for living purposes. Shelter, it is said, ranks second in the hierarchy of human needs; being most important after food. Available statistics show that 87% of the total household population in Nigeria lives in rented apartments. This fact, no doubt, makes Nigeria a viable investment destination for local and foreign investors, given the mammoth size of her population

Industrial Real Estate

These properties are used for manufacturing and production. Usually involves the construction of warehouses and factory floors. This sector of the industry is not so robust in Nigeria, due to the current low level of manufacturing activities in the country.

Overview Of The Nigerian Real Estate Market

In the past year, private equity firms have taken Africa’s real estate market by storm with millions of dollars in investments, especially in the commercial and hospitality sectors. The total investment in these sectors in the past 2011 is c. $652 million and analysts believe the Nigerian market is one of the most sought after, due to the huge returns possible.

The growing interest in the Nigerian market is as a result of huge demand buoyed by increasing urban population and changing shopping culture among the expanding middle class, which has resulted in the construction of numerous shopping malls. An average of 5.7 million Nigerians are considered to spend on the average US$10 to US$20 per day. The country also has an estimated $115 billion annual consumption spend.

There are c.10.7 million houses in Nigeria and we regard this statistics highly inadequate when compared to the size of the nation. To this end, the World Bank has esti-mated that it would cost as high as N59.50 trillion to bridge Nigeria’s 17 million hous-ing deficit. This huge deficit figure may also be viewed as a vast and untapped invest-ment potential of the country’s real estate sector.

Although the industry experienced a major lull from the Q2 of 2009 to the Q2 2011, the sector is gradually on the rebound and has experienced notable growth and per-formance. This performance is largely driven by the re-emergence of the Nigerian middle-class and the release of initially suppressed demand for decent residential and commercial accommodation by high net-worth individuals, corporate organizations and key players in the retail merchandising sector.

Growth in the sector has also been enhanced by the entrance and expansion of new and existing multinational companies in sectors such as ICT, oil and gas, retail mer-chandising and finance. The upturn in economic activity; experienced from Q4 2011 to date, has led to an increase in demand and supply for commercial and high-end resi-dential real estate development, particularly in the key cities of Abuja, Lagos and Port Harcourt. Discerning developers have focused on the construction of high-end resi-dential houses, commercial developments as effective demand has been strongest for these groups of developments. There has also been an encouraging increase in the construction of flats and condominium –type house, to aid affordability.

Outlook

The Nigerian market remains attractive as there are numerous opportunities available in the sector. There are opportunities for both institutional investors and real estate developers. We have identified viable opportunities in the following segments of the market for the immediate term:

· Hospitality;

· Shopping malls; and

· Office blocks

· Serviced flats

However, the challenge faced by the industry in terms of high and unfavorable interest rates is expected to persist in the short term. Hence, transactions must be critically reviewed prior to commencement. Nonetheless, the current recovery trend in economic factors is expected to continue, hence which may result in a downward pres-sure in lending rates.

SOURCE: PROSHARE NG