Ponzi schemes were named after Charles Ponzi, an American businessman who carried out one of the largest operations in history during the 1920s. However, he wasn’t the first one to do it, and the first Ponzi schemes date back to the early 19th century. The schemes have a lot in common with pyramid schemes, but there are also some key differences between the two.

Essentially, a Ponzi scheme is a form of fraud where the founder attracts new investors for his non-existent or failing business, promising high returns and low risk. Then, as new investors begin paying money to the schemer, earlier investors start receiving the profits, believing they come from the success of the business when in reality, they come from fellow investors.

Unlike a pyramid scheme, where investors need to lure in other participants to make any profit, in a Ponzi scheme, the founder works directly with the investors. The scheme can run for a long time, but all of them inevitably fail, leading to the participants losing their profits and their initial investments.

Most Popular Ponzi Schemes In Nigeria

Even though the Central Bank of Nigeria and other official sources continuously warn Nigerians about the dangers of Ponzi and pyramid schemes, thousands of Nigerians are still lured into these schemes every year by the promise of quick returns with no risks or hard work. These are the most popular schemes that have operated in Nigeria recently:

- MMM

- Twinkas

- Loom

- iCharity Nigeria

- Loopers Club

- MMM Cooperation

- Help Naija

- Paradise Payment

- NNN Nigeria

These Ponzi schemes operate under different pretences. Some of them even claim to be mutual aid funds for Nigerians who are struggling financially. Obviously, all of this is a bunch of lies and you are guaranteed to lose your money in the end even if you receive a small profit in the beginning.

How To Identify A Ponzi Scheme

The names of the schemes we listed earlier are the names of the Ponzi schemes that have already been identified as frauds, so you are probably not going to consider joining them. However, new Ponzi schemes appear every year and can seem very attractive to new potential investors. Here is how to know when you are being recruited for a Ponzi scheme:

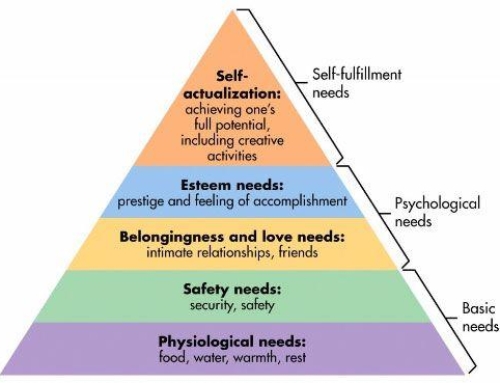

- Guarantee of high returns: Even the most powerful and established hedge funds never give their investors any guarantees. When anyone promises you high returns on your investments no matter what the circumstances are, it’s likely a fraud.

- Low risks: Every investment comes with a risk, and the higher the promised return is, the higher the risks are going to be. High-return low-risk investments simply don’t exist, no matter what the member of the scheme may tell you.

- No questionable paperwork: Even in our digital age, every investment, especially a major one, needs to come with a certain amount of paperwork. If you are not given any paperwork or it seems inconsistent and made by an amateur, it’s probably part of a Ponzi scheme.

- Unclear terms: As an investor, you have every right to know where your money goes, how the returns are calculated, and what are the possible risks of your investment. If you are not given any of that information, it’s probably because someone is trying to lure you into a Ponzi scheme.

- The requirement to recruit others: If you are required to bring new investors to receive any profit or to advance to the next level within the company, you are undoubtedly dealing with a scheme with some elements of a pyramid scheme.

SOURCE: brandspurng.com