“Is Nigeria launching its own Bitcoin? Is the Naira going to be as valuable as the dollar? Are we now going to save our Naira on crypto exchanges?”

These are questions a young friend of mine bombarded me with when I mentioned that Nigeria was going to have its own digital currency. I responded with a confident “no” however I had no answer to the follow-up. “How exactly would it work?”

Digital currencies have grown in popularity over the years. One of the most notable being Bitcoin, the first successful version, created in 2009 by the elusive Satoshi Nakamoto.

Its popularity stems largely from the stories of people who made huge sums of money investing it and ironically those who lost money through it.

At a Senate hearing in February, the Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, famously described them as ‘money out of thin air.’

In an interesting turn of events, the CBN is using the technology behind this “money out of thin air” to create the eNaira. It revealed on July 22, 2021, that the pilot scheme for the project will begin.

While digital currencies like Bitcoin, Ethereum and Elon Musk’s coveted Dogecoin are relatively popular, central bank digital currencies (CBDCs) are not as well-known.

A digital currency issued by a government works differently from a cryptocurrency like Bitcoin. Cryptocurrencies are not controlled by a singular entity. The creation and distribution of Bitcoin is decentralised meaning anyone can participate.

To get an insight into how CBDCs work, Techpoint Africa spoke with some experts about what to expect as Nigeria launches its CBDC in October.

Why is Nigeria launching the eNaira?

Adedeji Owonibi, founder and COO of Blockchain solutions company, Convexity, explains that CBDCs are trending and countries want in on the action. Over 80 countries are testing and researching the possibility of a central bank digital currency.

He adds that the CBN was also fearful of the traction cryptocurrencies were getting. Ownonibi, who is also a crypto forensic investigator, explains that he tried to allay their fears. “When the central bank displayed their fear about crypto gaining so much traction, I was invited to speak with them and I explained how crypto monitoring can be done through the banks.”

Ankit Singhal, CTO of Modulus, US-based financial solutions company, says countries are adopting CBDCs “because they have realised the capability of the Blockchain, how fast, cheap and reliable they’re”

According to a PowerPoint presentation seen by Techpoint Africa, the CBN says the objective of the eNaira is to aid financial inclusion, improve payment efficiency, improve revenue and tax collection, targeted social interventions, amongst other objectives.

While the eNaira will play an important role in financial inclusion and propel a cashless policy, Owonibi believes it will not have any major improvement on the Nigerian economy.

Singhal in contrast sees the adoption of CBDCs as a realisation of the power of Blockchain. The technology, he says, can improve several sectors of the African economy.

What are CBDCs and how do they compare to cryptocurrencies?

CBDCs are digital currencies issued by the government. While they might share similarities with cryptocurrencies — running on a Blockchain for example — they’re not necessarily cryptocurrencies.

In the words of Chimezie Chuta, Founder/ Coordinator Blockchain Nigeria User Group, Vice Chairman Blockchain Industry Coordinating Committee of Nigeria (BICCoN), and Member Fintech Alliance Coordinating Team (FACT), “There are characteristics that make cryptocurrencies what they’re which CBDCs are not.”

He states that the CBN is not creating a cryptocurrency as some might think. “What they’re trying to do basically is to turn our Naira fiat currency into a currency that is designed for the internet.”

Simply, CBDCs are currencies created digitally to facilitate digital transactions. While we can already perform digital transactions with the Naira, the eNaira does not need to be backed by physical cash.

Will the eNaira grow in value like Bitcoin?

The eNaira will not grow or plummet in value like Bitcoin or other cryptocurrencies.

Interestingly, the eNaira will function the same way the Naira does. The difference being the former is digital. The eNaira will be pegged to the Naira so their value remains the same, like stable coins pegged to the dollar.

“Issuing CBDC will not suddenly turn your fortunes around,” Chuta says.

The eNaira is pegged to the Naira, meaning it maintains the value of the Naira.

Owonibi corroborates Chuta’s stance, emphasising that the eNaira “doesn’t provide insulation from inflation.”

Essentially, it works the same way stablecoins maintain value. A stable coin is a cryptocurrency that is immune to volatility. They are pegged to with a fiat currency and hold the same value as the fiat. Per Investopedia, they are backed by reverse assets like commodities or a foreign currency. In the case of the eNaira, it will be backed by the Naira.

How will the eNaira work?

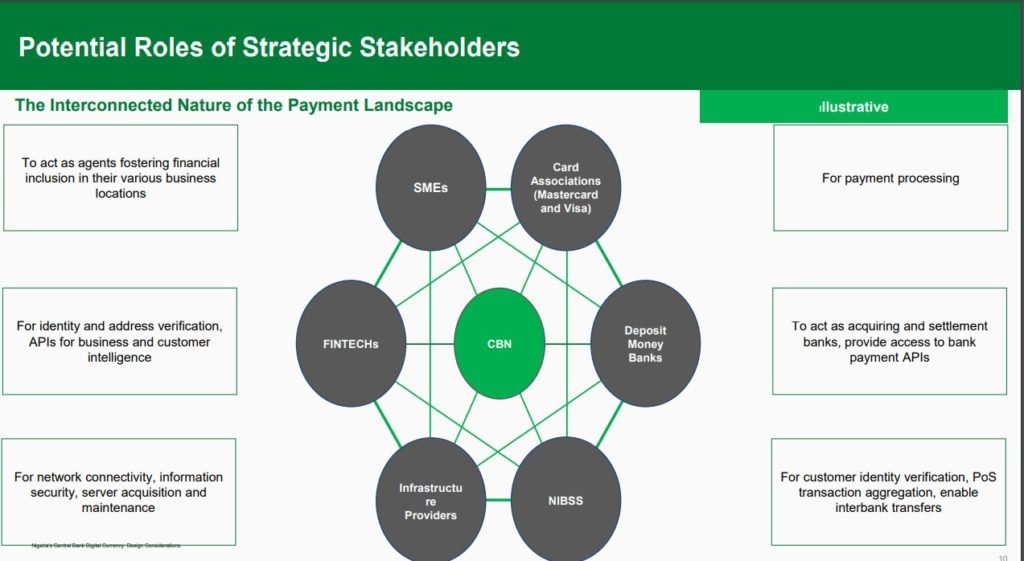

Owonibi, who is one of the brains consulted by the CBN on how a digital currency could work, reveals that banks and fintech will have a significant role to play in deploying the eNaira.

“The interconnected nature of the payment landscape will be maintained, meaning…the deposit money banks and Nigeria Inter-bank Settlement System (NIBSS) will still have a role…fintech companies will also have a role and the central bank will be in the middle.”

This suggests that while the Hyperledger Fabric Blockchain, the Blockchain network selected by the CBN for the eNaira to run on, is permissioned, the government will grant access to all the parties stated by Owonibi. Nevertheless, it has full control of the system.

Financial institutions will play roles in identity verification, payment processing amongst other things.

Owonibi adds that “anyone holding a fintech licence can mint the eNaira and also create wallets for customers.”

In Chuta’s explanation of how the digital currency will work, he points out that it will be a peer-to-peer (P2P) transaction by people who have the eNaira wallet “ just like we do in crypto, the wallets will enable you to store, send and receive the eNaira”

In contrast to Owonibi’s claim that fintech with licences will be able to mint the eNaira, Chuta believes the CBN will be the only one minting the digital currency. A legal claim by the CBN will back up every digital currency minted to keep inflation in check. He describes it as “a legal claim of the availability of that Naira in a physical vote”

Chuta highlights steps for the implementation of the eNaira which includes issuing of the currency by the CBN, distribution through licensed financial institutions, exchange between individuals and businesses and monitoring by the CBN.

Owonibi clarifies further by saying wallets will be created through financial institutions the same way bank accounts are created.

Similarly, China’s digital Yuan is being distributed through commercial banks. PerCNBC, they will be responsible for getting the currency in the hands of consumers.

Will the eNaira be connected with existing bank accounts?

No, the eNaira will be created independently of bank accounts. According to Owonibi, the wallets will be created by financial institutions that will create customer identification through an application product interface (API).

Chuta on the other hand says the connection of CBDC wallets to existing bank accounts is a bit tricky. While he’s not certain, he believes that there should be a linkage between Bank Verification Numbers (BVN) and the wallets. “Without that, an individual could have two identities,” he says.

In China’s case, however, the digital Yuan has no ties with existing bank details. People’s Bank Of China (PBOC) Deputy Governor, Fan Yifei tells CNBC that existing bank accounts may not necessarily be linked to digital Yuan wallets.

Can the government monitor transactions with the eNaira?

Yes, the government can monitor all eNaira transactions on the Hyperledger Fabric Blockchain.

The government is issuing a CBDC to maintain its own monetary sovereignty, Chuta tells Techpoint Africa. If cryptocurrencies like Bitcoin and Etherum gain more traction, the government will lose that control. Hence the eNaira is a way of retaining control.

He admits that “sadly”, the government sees and controls all that happens with the eNaira directly.

“At which point do you clear the intersection of citizens’ privacy?”

These are some of the questions Owonibi says he put to the CBN but got no response. He reveals that the Chinese government unequivocally stated that transactions with the digital Yuan will be monitored meticulously. Perhaps Nigeria could follow suit.

Several questions remain unanswered

Until the pilot scheme for the eNaira commences in October, no one knows for sure what to expect. From how cross border payments will work, to how privacy will be ensured, Owonibi admits to me that he has several unanswered questions

Come October, he hopes to get more clarity.

SOURCE: https://techpoint.africa