If you’ve heard it once, you’ve heard it a thousand times: BUDGET YOUR MONEY! Financial experts and money advisors have been shouting this mantra from the mountaintops for years.

Still not convinced? Below are six good reasons why everyone should create and stick to a budget.

1. It Helps You Keep Your Eye on the Prize

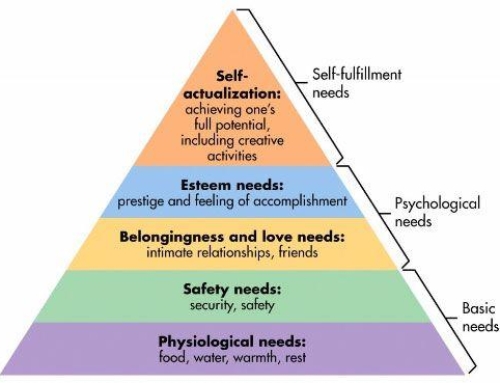

A budget helps you figure out your long-term goals and work towards them. If you just drift aimlessly through life, tossing your money at every pretty, shiny object that happens to catch your eye, how will you ever save up enough money to buy a car, take that trip to Ogudu Ranch, or put a down payment on a house?

A budget forces you to map out your goals, save your money, keep track of your progress, and make your dreams a reality. OK, so it may hurt when you realize that brand new Smart TV from Jumia or the gorgeous cashmere sweater in the store window doesn’t fit into your budget. But when you remind yourself that you’re saving up for a new house, it will be much easier to turn around and walk out of the store empty-handed.

2. It Ensures You Don’t Spend Money That You Don’t Have

Far too many consumers spend money they don’t have—and we can owe it all to credit cards.

Before the age of plastic, people tended to know if they were living within their means. At the end of the month, if they had enough money left to pay the bills and sock some away in savings, they were on track. These days, people who overuse and abuse credit cards don’t always realize they’re overspending until they’re drowning in debt.

Let’s say you spend your money responsibly, follow your budget to a T, and never carry credit card debt. Good for you! But aren’t you forgetting something? As important as it is to spend your money wisely today, it’s also critical to save for your future.

4. It Helps You Prepare for Emergencies

Life is filled with unexpected surprises, some better than others. When you get laid off, become sick or injured, go through a divorce, or have a death in the family, it can lead to some serious financial turmoil. Of course, it seems like these emergencies always arise at the worst possible time—when you’re already strapped for cash. This is exactly why everyone needs an emergency fund.

Don’t try to dump the majority of your paycheck into your emergency fund right away. Build it into your budget, set realistic goals and start small. Even if you put just $10 to $30 aside each week, your emergency fund will slowly build up.

5. It Sheds Light on Bad Spending Habits

Building a budget forces you to take a close look at your spending habits. You may notice that you’re spending money on things you don’t need. Do you honestly watch all 500 channels on your costly extended cable plan? Do you really need 30 pairs of black shoes? Budgeting allows you to rethink your spending habits and re-focus your financial goals.

6. It’s Better Than Counting Sheep

Following a budget will also help you catch more shut-eye. How many nights have you tossed and turned worrying about how you were going to pay the bills? People who lose sleep over financial issues are allowing their money to control them. Take back the control. When you budget your money wisely, you’ll never lose sleep over financial issues again.