A mortgage refers to a legal agreement that conveys conditional right of ownership of a property (typically landed) by its owner to a lender as security for a loan (www.businesssdictionary.com).

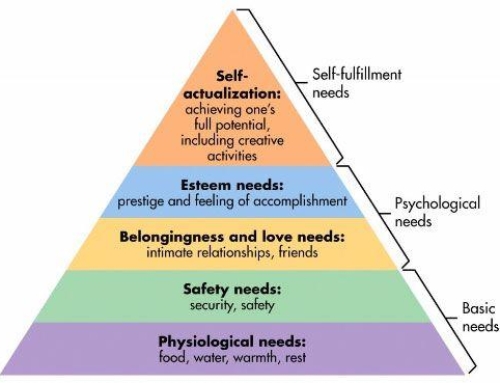

In Nigeria, where the majority of the citizenry are of the middle class socio-economic standing, purchasing a home fully funded by private capital might be a herculean task and will probably take many years of savings to accomplish.

A mortgage however, reverses that system. How? Instead of saving for about 20 years to finally be able to afford a home, a mortgage can help you purchase the home, and then pay gradually over a period of that same 20 years.

The body set up by the Federal Government to cater to this in Nigeria is the National Housing Fund (NHF). There are also several other commercial mortgage facilitators, almost every bank has a mortgage arm from which clients can obtain a loan.

How Does The Process Work?

Mortgages are also loans which mean that they come with interest rates. Typical mortgage interest rates in Nigeria range between 7-10% for the NHF and between 15-25% for commercial mortgage institutions. Aside from the interest payable, the potential buyer must also have a certain percentage of the total amount needed for the purchase readily available; this amount is known as equity and should range between 30-70% of the total cost of the home.

Another important factor to consider is the tenor of the loan; this is the length of time required to pay back the loan. In most situations in Nigeria, the maximum amount of time given is 20 years.

When approaching any mortgage institution for a loan, the most important factor they will consider before approving your request is your income. Ideally, mortgage payments should not take more than 25-30% of your monthly income, this ensures that you still have enough to be able to take care of other responsibilities and hence, do not default on your loan payments.

What Documents Do You Need?

Requirements may vary depending on the institution but the items listed below are always constant

- A comprehensive statement of account (12 months or more)

- Employment and confirmation letter (if employed)

- Certificate of Incorporation of business (if in business)

- Nationally accepted means of identification

- Utility bills

- Application form (provided by mortgage institution)

- Original title deed of property ( To confirm that property is not in contest)

In Nigeria, a lot of people are still very sceptical about taking home mortgages; however, this is one of the surest and easiest ways of owning your own home. I advice that you sit down and do a proper analysis of your financials to see if a mortgage can be in the works for you.

Also, if you’re concerned of being overly burdened with paying off interests, I recommend trying out the National Housing Fund as their interest rates are significantly lower. However, this will only work if you’re seeking a small loan as their maximum loan amount is N15million. On the upside, if you don’t have a lot of equity, this will still work for you as the NHF can finance up to 90% of the cost of the home.

However, if you’re looking to take an amount over N15million, then you should consider going to a commercial mortgage institution. In any case, you would do well to do your research on the institution, the property and also a proper and feasible analysis of your financials to ensure that you can really afford the mortgage.

If in doubt, please engage the services of a professional property and investment broker to be sure that you are making the right step.

SOURCE: lvg.com.ng